The Financial Stability Oversight Council and The Treasury Department

Financial Stability Oversight Council (FSOC)

The Financial Stability Oversight Council (FSOC) was created by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 in response to the devastating 2008 financial crisis. FSOC is charged with “identifying risks to the financial stability of the United States; promoting market discipline; and responding to emerging threats to the stability of the U.S. financial system.” In other words, FSOC’s job is to assess, monitor and mitigate complex systemic risks to our financial system and the wider economy, risks like those that derailed the economy during the 2007-09 financial crisis.

Background

The Great Recession, fuelled by the reckless actions of large banks, revealed major vulnerabilities in the U.S. financial regulatory and oversight framework. Before the crisis, no single regulator was responsible for monitoring and addressing systemic risks across the financial system. Regulators were uncoordinated and narrowly focused on individual institutions and jurisdictions. This left many important parts of the system unregulated and allowed for the build up of significant risk that eventually led to a crash. So, Congress formed FSOC to help our government address problems that pose systemic financial risks to our economy — like climate change.

What Does FSOC Do?

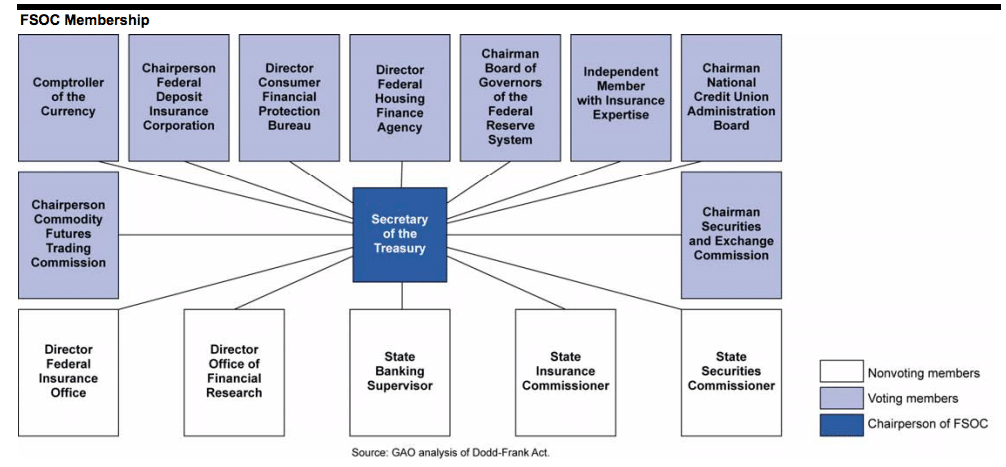

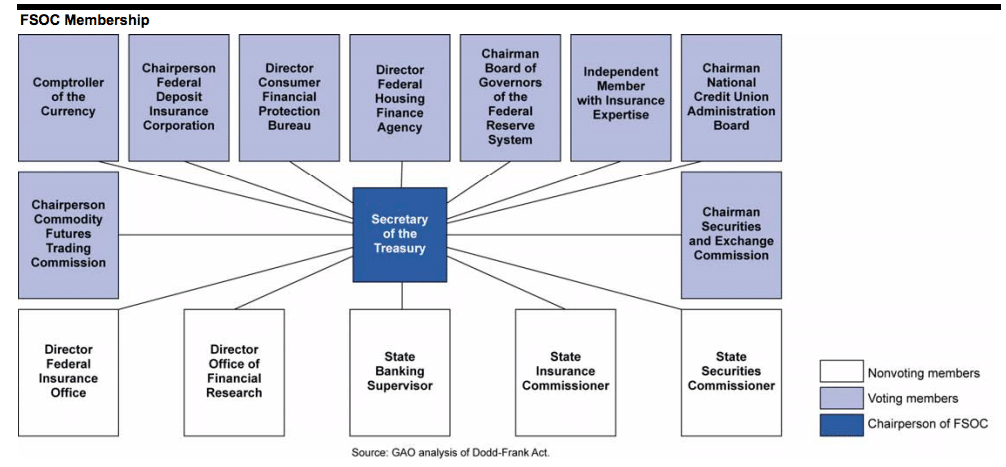

FSOC is composed of 15 members (see below for full list of ten voting members and five non voting members) and is headed by the Chair of the Treasury Department or Treasury Secretary, currently Janet Yellen. FSOC members include the most powerful financial regulatory agencies like the Federal Reserve and the Securities and Exchange Commission.

Part of FSOC’s role is to convene these federal financial regulators, as well as state regulators and one independent insurance expert appointed by the President. The goal is to facilitate inter-agency coordination, cooperation and communication, information sharing, planning, and the mitigation of financial stability threats. While FSOC doesn’t have direct regulatory authority and cannot force agencies to comply with its recommendations, it plays a crucial role in identifying and preventing major financial crises.

Treasury Department

The Treasury is in charge of managing all federal finances, for collecting taxes, paying bills, managing currency, government accounts, and public debt. The Chair of the Treasury Department, currently Janet Yellen, heads-up FSOC. As a convener of FSOC, Treasury has a big role to play in identifying, assessing, and responding to the risks climate change poses to the financial system.

Climate-Related Financial Risk, FSOC and Treasury

FSOC

FSOC’s role in addressing climate-related financial risk is pretty straightforward. (Check out our explainer on climate-related risks here). Climate-related risks have implications for every part of the financial system and every aspect of our economy, which means it has implications for every financial regulator. It is amongst the most pressing emerging threats, placing this issue directly under the remit of FSOC, which was designed to address this kind of cross-system risk. In fact, in 2021 FSOC identified climate change as an “emerging and increasing threat to financial stability”, and released a 133 page report with accompanying recommendations for member agencies.

In 2022, FSOC established the Climate-related Financial Risk Advisory Committee, to help the Council receive information and analysis on climate-related financial risks from a broad array of stakeholders. The advisory committee had its first meeting in March 2023.

Treasury

Following Biden’s Executive Order, “Tackling the Climate Crisis at Home and Abroad”, Treasury made the following commitment:

“…Treasury is committed to using its broad and far reaching policy influence to lead and support this important agenda. It will play a significant role working with other federal agencies, foreign governments, and international financial institutions to stimulate global action on addressing climate change, environmental justice, and working to prevent climate change-created economic and financial crises.”

In line with the above, the Treasury created a Climate Hub in 2021, headed until recently by John Morton — who has now returned to the private sector. Secretary Janet Yellen has yet to appoint a new Hub Counselor. The Climate Hub counselor is central to hastening Treasury and FSOC progress on protecting the financial system from climate-related financial damages, while unlocking the financing needed for investments to achieve a zero carbon economy at home and abroad in the public interest.