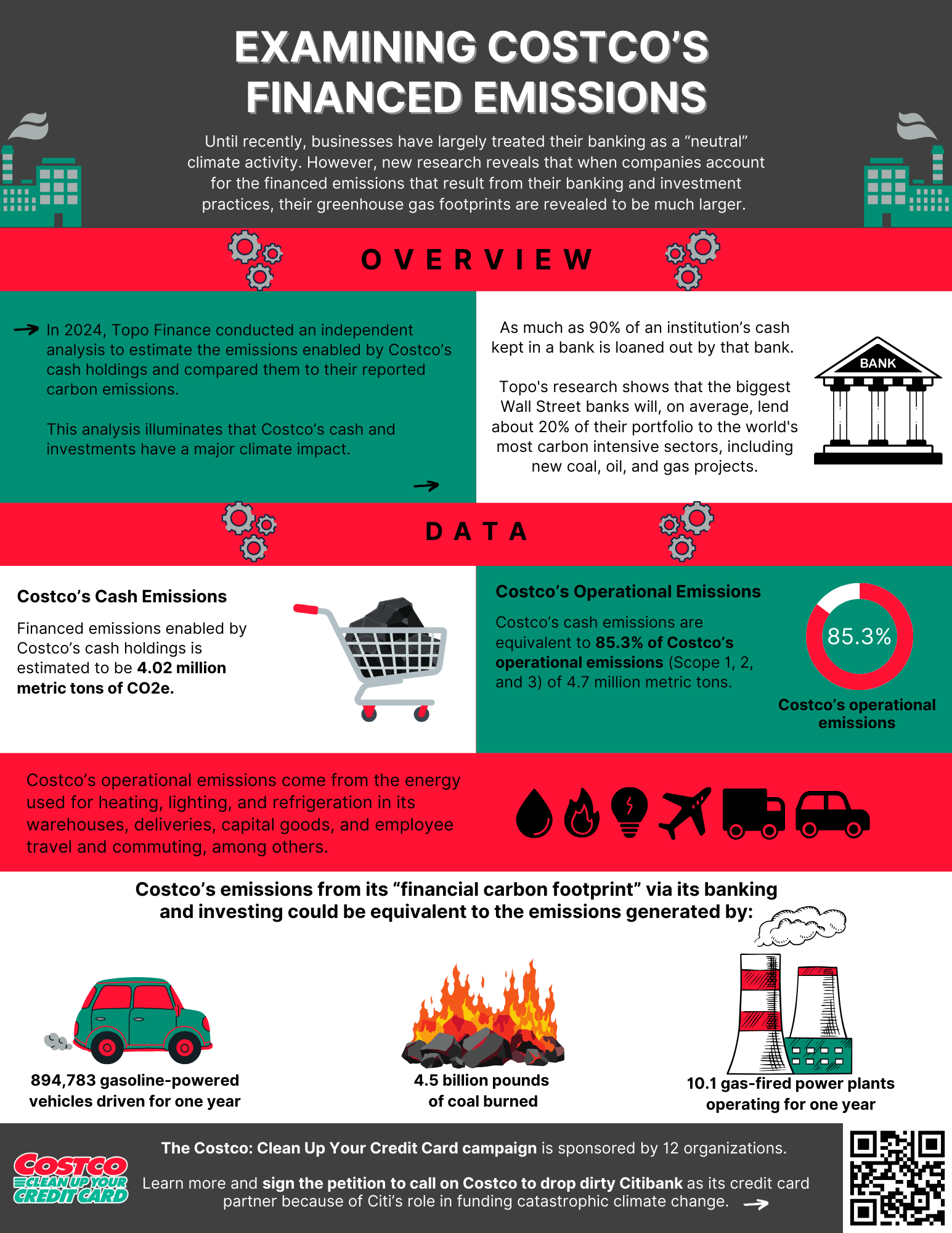

Until recently, businesses have largely treated their banking as a “neutral” climate activity. But new research says otherwise. In 2024, Topo Finance conducted an independent analysis to estimate the emissions enabled by Costco’s cash holdings and compared them to their reported carbon emissions.

This analysis illuminates that Costco’s cash and investments have a major climate impact. As much as 90% of an institution’s cash kept in a bank is loaned out by that bank. Topo’s research shows that the biggest Wall Street banks will, on average, lend about 20% of their portfolio to the world’s most carbon intensive sectors, including to develop new coal, oil, and gas projects.

See our new infographic below, and like and share this announcement on social media:

Then, get involved: Sign our petition which calls on Costco to drop dirty Citibank as its credit card partner because of Citi’s role in funding catastrophic climate change: stmp.link/CostcoPetition