wHO WE ARE

We are a coalition that came together to fight fossil fuels and environmental racism. We believe that everyone deserves a right to a safe, livable future.

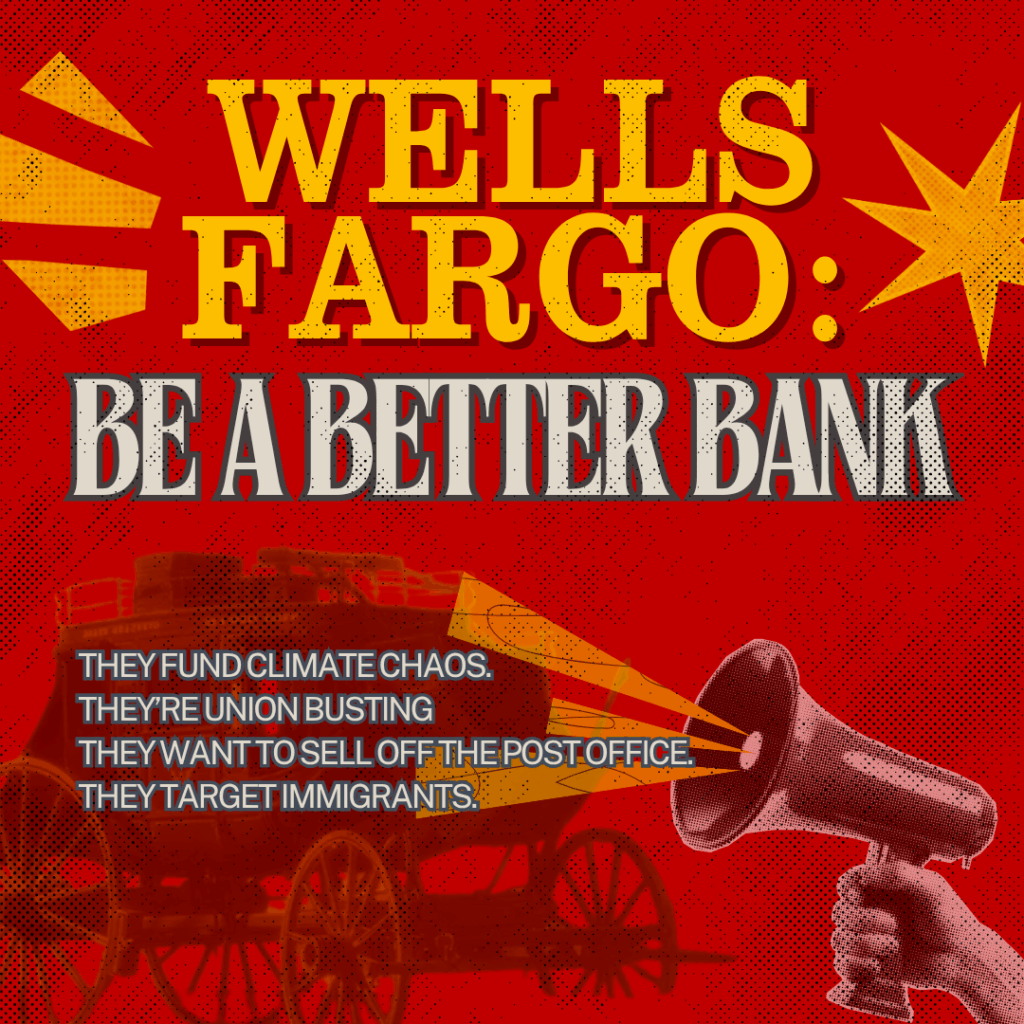

And we run hard-hitting campaigns to challenge the corporations and billionaires driving the climate crisis and the rise of authoritarianism.

ABOUT US